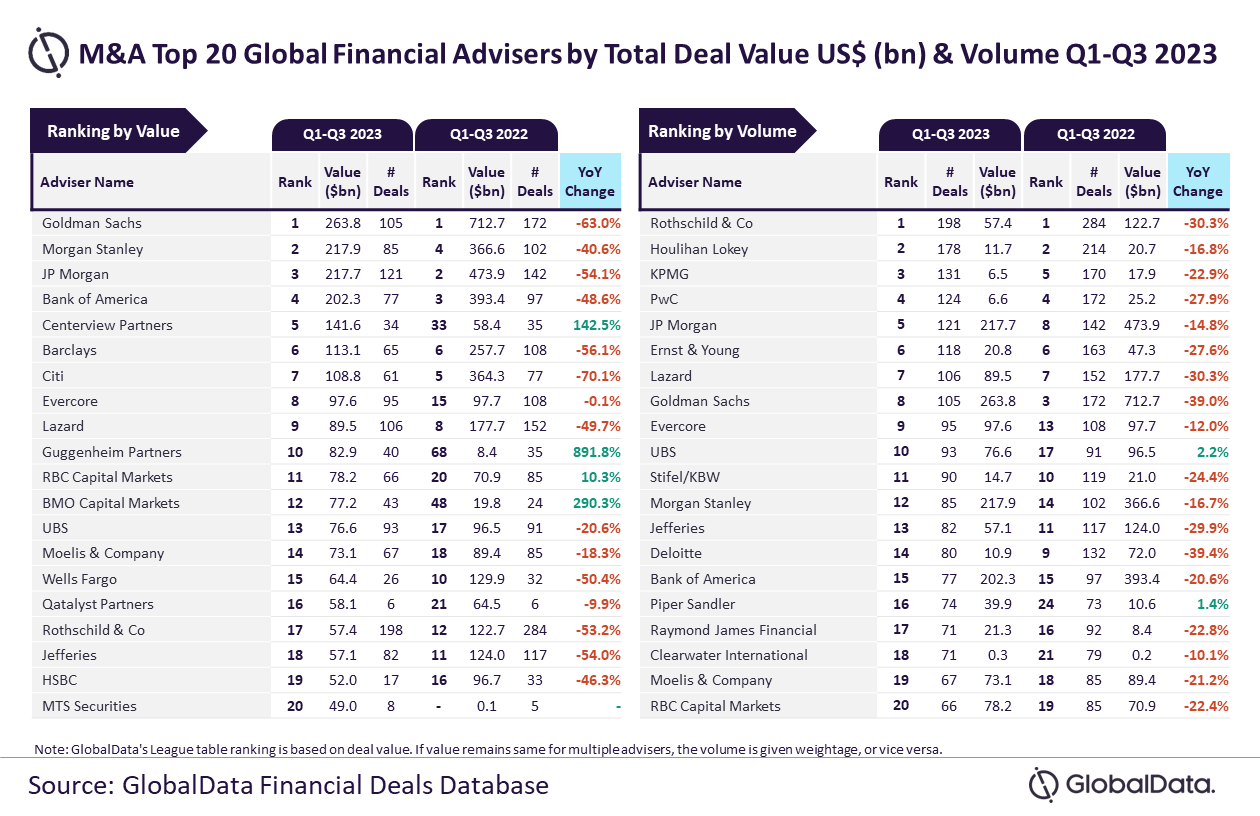

Goldman Sachs and Rothschild & Co were the top M&A financial advisers globally in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers.

Goldman Sachs topped the charts when measuring the value of deals, advising on $263.8bn worth of deals during the period, while Rothschild & Co advised on the most transactions with a total of 198 deals.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“Most of the top 20 advisers by value as well as volume registered decline in the number of deals they advised on and the corresponding deal value during Q1-Q3 2023 compared to Q1-Q3 2022 as market conditions remained volatile and M&A activity suffered significant setbacks across most of the markets globally,” said GlobalData lead analyst Aurojyoti Bose. “Macroeconomic challenges, the ongoing Russia-Ukraine war and uncertain market sentiments have taken a toll on deal-making sentiments.

“However, Goldman Sachs, despite experiencing a decline in total value of deals advised by it during Q1-Q3 2023 compared to Q1-Q3 2022, managed to retain its leadership position by this metric. Goldman Sachs advised on 49 billion-dollar deals [valued at or above $1bn], of which seven were mega deals valued more than $10bn. The involvement in such big-ticket deals helped Goldman Sachs top the chart by value.

“Similarly, Rothschild & Co also registered a decline in the number of deals advised by it but managed to retain its ranking by this metric. It fell short of only two deals from touching 200 deals volume mark.”

Morgan Stanley came second in terms of value by advising on $217.9bn worth of deals, followed by JP Morgan with $217.7bn, Bank of America with $202.3bn and Centerview Partners with $141.6bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeasured by number of transactions, KPMG was second with 14 deals, followed by Houlihan Lokey and PwC with 12 deals each, and Ernst & Young with 11 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.