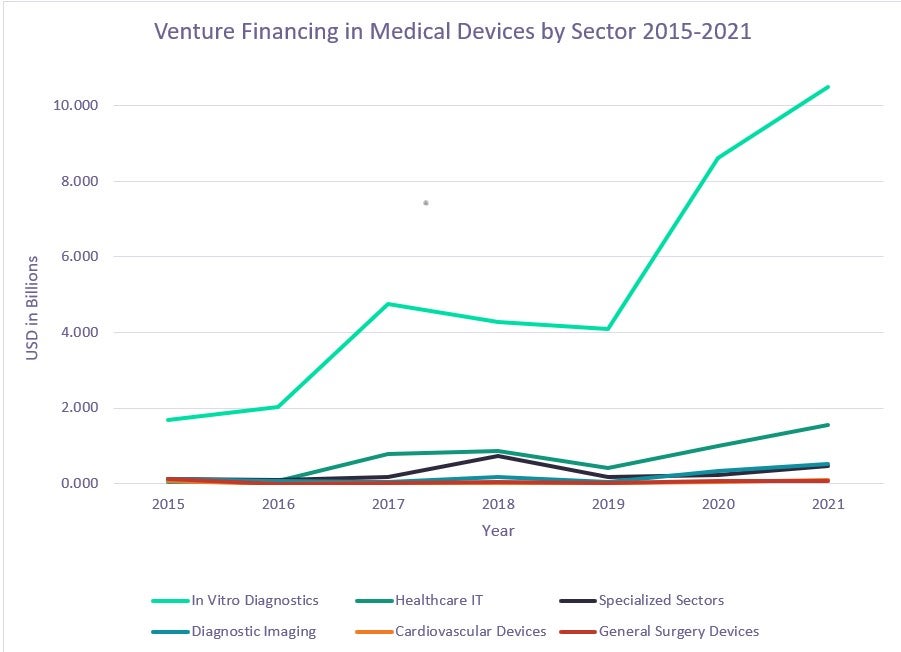

Over $4.3bn has been raised in venture capital (VC) for in vitro diagnostics (IVD) since the start of 2022. GlobalData expects that IVD will continue to lead VC deals in 2022 after reaching $10.49bn and $8.63bn in 2021 and 2020, respectively. In 2021 alone, companies in the oncology IVD space raised $820m, much of which went to fund cancer screening tools. Other large markets that follow IVD are healthcare IT, specialised sectors like oncology and neurology medical equipment, and diagnostic imaging, which reached $1.54bn, $459m and $518m in VC financing in 2021, respectively.

This July, Delfi Diagnostics raised $225m in Series B financing after last January’s $100m for developing blood-based liquid biopsy tests. By analyzing cell-free DNA fragments from across the genome, the test detects multiple types of cancer simultaneously and monitors cancer treatment. Similarly, in June, Epic Sciences completed a $43m Series F financing round to expand the company’s multi-omic platform, which includes a multi-analyte assay to diagnose metastatic breast cancer by detecting cancer biomarker protein expression in circulating tumour cells and cancer gene amplification from the cancer cells in a patient’s blood sample. The growth in minimally invasive and high-performing oncology tests through VC will continue to drive scientific innovation in the IVD market for years to come.

Therefore, based on recent VC deals in 2022 and historically leading medical devices in VC deals by value, IVD will continue this trend in the coming years.