Business optimism decreased in September 2022 compared to August 2022, according to an ongoing poll by Verdict, amidst businesses expressing concerns about rising inflation and its impact on the overall economy.

Verdict has been conducting the poll to study the trends in business optimism during COVID-19 as reflected by the views of companies on their future growth prospects amid the pandemic.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

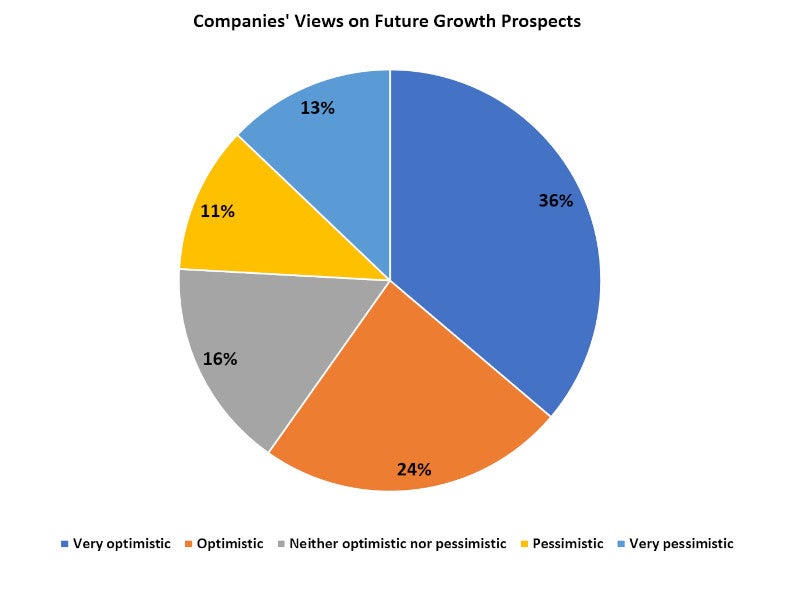

Analysis of the poll responses recorded in September 2022 shows that optimism regarding future growth prospects declined by two percentage points to 60% from 62% in August 2022.

The respondents who were optimistic decreased to 24% from 26% in August, while those very optimistic remained the same at 36% in September.

The respondents who were pessimistic increased by one percentage point to 11% in September, whereas those who were very pessimistic declined by two percentage points to 13% from 15% in August.

The percentage of respondents who were neutral (neither optimistic nor pessimistic) increased by three percentage points to 16% from 13% in August.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe analysis is based on 373 responses received from the readers of Verdict network sites between 01 September and 30 September 2022.

Australia’s business sentiment dips to lowest levels since April 2020

The seasonally adjusted S&P Global Australia Manufacturing Purchasing Manager’s Index™ (PMI™) declined to 53.5 in September from 53.8 in August. The survey results indicated that the health of Australia’s manufacturing sector had improved during the month, although the pace of overall growth dropped.

Slower rate of employment on account of hiring challenges, a decline in vendor performance caused by supply chain disruptions, and a notable decline in pre-production inventory levels were the main reasons attributed to the drop in growth.

The PMI also indicated that business optimism hit the lowest levels since April 2020, mainly due to the concerns related to the cost-of-living crisis and the impact of inflation on the economy.

Rising inflation in Spain and Poland impacts business confidence

The seasonally adjusted S&P Global Spain Manufacturing PMI® fell to 49 in September, from 49.9 in August. The decline was attributed to a decrease in output and new orders caused by high inflation and reduced demand. Business confidence about the future, as a result, slipped into the negative territory amid an uncertain economic climate characterised by high inflation and low consumption.

Confidence remained subdued in the manufacturing sector in Poland as the S&P Global Poland Manufacturing PMI® was well below the 50 no-change mark during September. The slowdown resulted from a decline in output and new orders at historically significant rates. Business confidence was low as input cost inflation accelerated during the month for the first time since March resulting from the rise in energy prices. Firms were forced to cut jobs to reduce costs, which caused employment levels to drop for a fourth successive survey period.

Optimism declines across major sectors in Italy, Latvia and Germany

Business optimism declined to 105.2 in September from 109.2 in August in Italy, according to the Istat Economic Sentiment Indicator of The Italian National Institute of Statistics (ISTAT). Market services confidence index declined to 95.9 from 103.0 as expectations for future orders deteriorated, while confidence in the manufacturing sector declined to 101.3 from 104. Retail trade confidence also declined to 110.6 from 113.4. Compared to the previous month, respondents gave more pessimistic opinions on current business trends and future sales.

Data from the business tendency surveys conducted by the Central Statistical Bureau (CSB) showed that business confidence indicators in Latvia remained negative in all business sectors for the fourth consecutive month in September 2022. Indicators in construction, services, and manufacturing continued to fall in September compared to August due to insufficient demand, price rise of energy resources, and lack of labour force. Confidence indicator in the construction sector was -17.2, a decline of 1.6 percentage points from the previous month, while it was -8.4 in the manufacturing sector, a decline of 2.7 percentage points from the last month.

Optimism in the German economy declined to 84.3 points in September from 88.6 in August, according to the ifo Business Climate Index. The index hit the lowest since May 2020 affecting all four major sectors of the country including manufacturing, services, trade and construction. Companies rated their current situation as clearly worse. Pessimism about the future months also increased, with retail expectations being at an all-time low.

Belgium and Czech Republic witness sharp decline in business confidence

Belgium witnessed a sharp decline in confidence to -11.8 in September from -5.8 in August, according to the monthly business survey conducted by the National Bank of Belgium. Business climate deteriorated across all sectors of activity covered by the survey, with the exception of the construction industry where the indicator has remained virtually stable. Business leaders were less optimistic about the state of their order books and employment outlook.

The confidence indicator fell by 3.3 points to 93.6 in September in the Czech Republic, according to the NR Business cycle survey conducted by the Czech Statistical Office. Confidence in the economy among industrial entrepreneurs declined for the fourth time in a row. The number of entrepreneurs who were dissatisfied with their current total demand remained constant, though.

UK’s confidence weighed down by inflation and political instability

The Institute of Director’s (IoD) Economic Confidence Index, which measures business leader optimism in the UK, increased marginally upwards to -43 in September. The index of confidence in the prospects for their own business, however, declined to +20 from +28 in August. Business leaders stated that the rate of inflation in the UK and the political instability in the UK government were the main reasons for their pessimism.

The overall business confidence measured by the Lloyds Bank Business Barometer stabilised in September, after falling for three months in a row between June and August. In the North West and Yorkshire & the Humber regions, however, business confidence decreased by 14% and 11%, respectively. Confidence remained lower than the national average in other regions of the UK including South West, East Midlands, Northern Ireland, the East of England and Wales.

Canada’s small business confidence declines marginally

Canada’s small business confidence in the short and long-term fell to 49.5 in September, just half a point lower than that in August, according to the Canadian Federation of Independent Business’s (CFIB) Business Barometer® short-term index. An index above 50 indicates owner’s expectations of business performance to be stronger.

The general state of the business did not change since August, and full-time hiring plans for the next three to four months remain stagnant. Most provinces of Canada had bleak forecasts for the next three to four months, with readings below 50. Nova Scotia and Prince Edward Island were most optimistic, although their levels were in the mid-50s.