Mesa Laboratories has signed a definitive agreement to acquire Agena Bioscience for a total of $300m in cash, subject to standard purchase price adjustments.

A US-based molecular diagnostics tools company, Agena creates, manufactures and distributes sensitive, cost-effective, high-throughput genetic analysis solutions for clinical labs and development partners across the globe.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

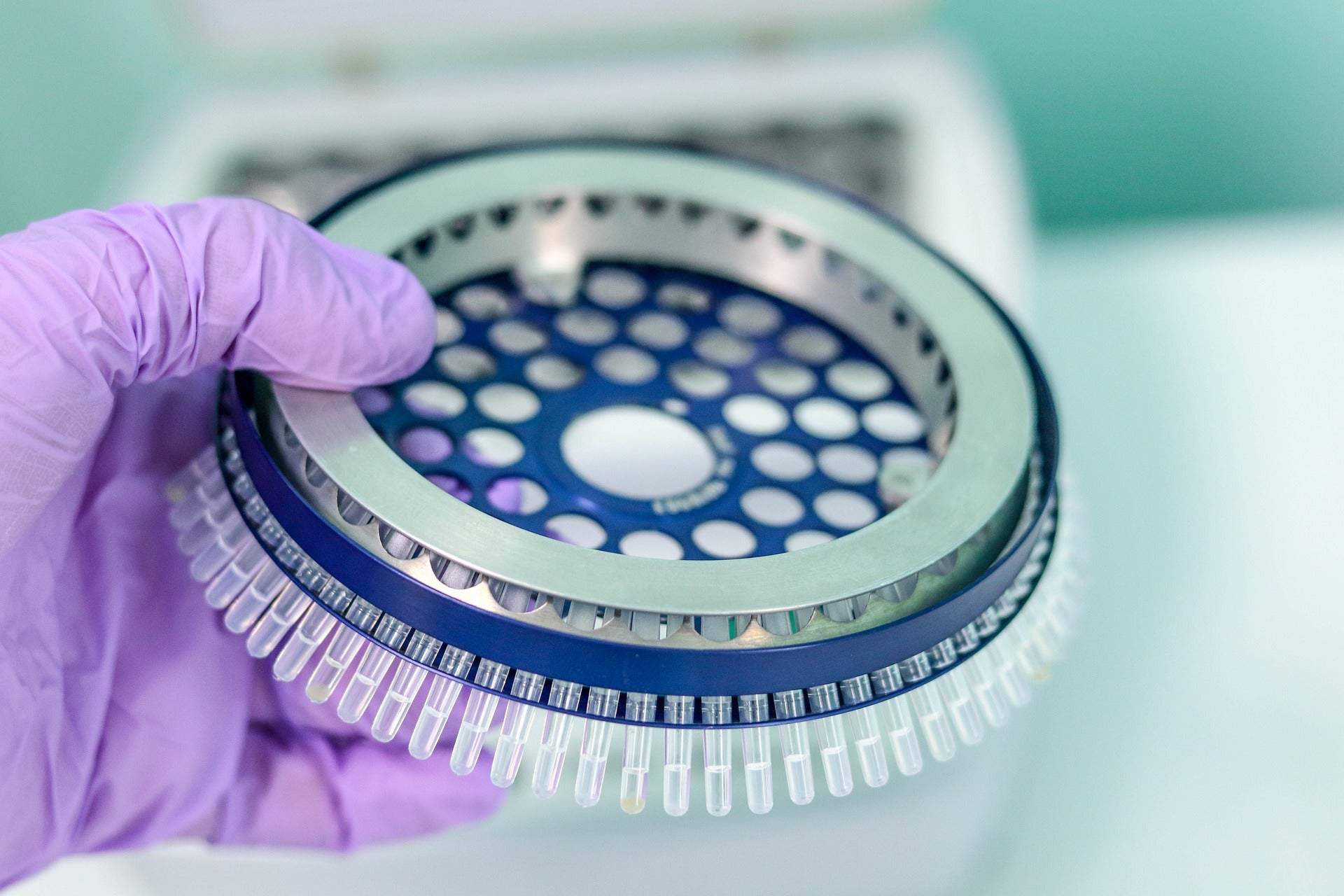

The company’s MassArray system is an established platform that merges mass spectroscopy and multiplex polymerase chain reaction (PCR), to offer sensitivity, cost-effectiveness, fast turnaround time, ease of use and flexibility.

Mesa anticipates Agena to generate between $63m and $67m in revenue, plus an additional $3m to $5m in Covid-19 testing revenue, within one year of acquisition.

In the following years, Mesa expects continued organic revenue growth in high single digits, with gross profit margins around $60m, even if Covid-linked revenues reduce.

On concluding the acquisition, Agena CEO Peter Dansky will lead the new Clinical Genomics Division of Mesa.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDansky said: “We are proud of our track record in bringing the power of genomics to the clinical setting in hereditary diseases, pharmacogenomics, oncology, infectious disease and sample integrity testing.

“We built our company based on a strong team-oriented values system, and we see a great fit with the Mesa culture.”

Jefferies served as the exclusive financial advisor, while DLA Piper (US) was the legal advisor to Agena.

Davis Graham & Stubbs was Mesa’s legal advisor.

Mesa plans to fund the all-cash deal through a combination of cash on hand and proceeds from its credit facility.

Subject to necessary conditions and regulatory approvals, the acquisition is anticipated to conclude in Mesa’s third fiscal quarter, ending 31 December.

Mesa designs and manufactures quality control solutions for medical devices, as well as pharmaceutical and healthcare industries.

It operates through Sterilization and Disinfection Control, Biopharmaceutical Development, Instruments and Continuous Monitoring divisions.