Cardiovascular diseases (CVDs) remain a major global driver of morbidity and mortality, with the Global Burden of Disease study putting global CVD-related deaths at 20.5 million in 2021. As such, it is no surprise that cardiovascular medicine remains a major area of innovation in Israel’s medtech space.

The coverage of blood vessels within the human body is so extensive that different therapeutic targets in the space fall under the umbrella term of cardiovascular medicine. Not everything is focused on the heart itself, and the Israeli medtech ecosystem is increasingly looking to unify therapy solutions.

In 2023, Israel held a 16.4% market share in the cardiovascular medical devices market in the Middle East and North Africa (MENA) region, according to GlobalData’s Market Size & Growth database.

At the recent Biomed 2024 Israel conference, Magenta Medical CEO David Israeli moderated a session titled “Why does cardiovascular disease remain the number ONE target for MedTech innovation?”

Featuring keynotes from Doron Harlev, co-founder and CEO of Affera and Beni Surpin, and partner at Goodwin Procter, the session reflected on why medical devices are a critical driver of cardiovascular innovation.

Overall investment in Israel’s cardiovascular devices market stood at $263m in 2023, up from around $244m in 2022.

Medical Device Network sat down with Israeli to discuss the current focuses for cardiovascular innovation and the state of market competition in Israel.

Ross Law (RL): What are the current key drivers of cardiovascular innovation in Israel?

David Israeli (DI): Most of the innovation in cardiovascular medicine is currently more biased in the direction of medical devices because most of the problems are either anatomically driven or driven by rhythm disturbances. And these families of conditions are often more apt for mechanical solutions than biotherapeutics.

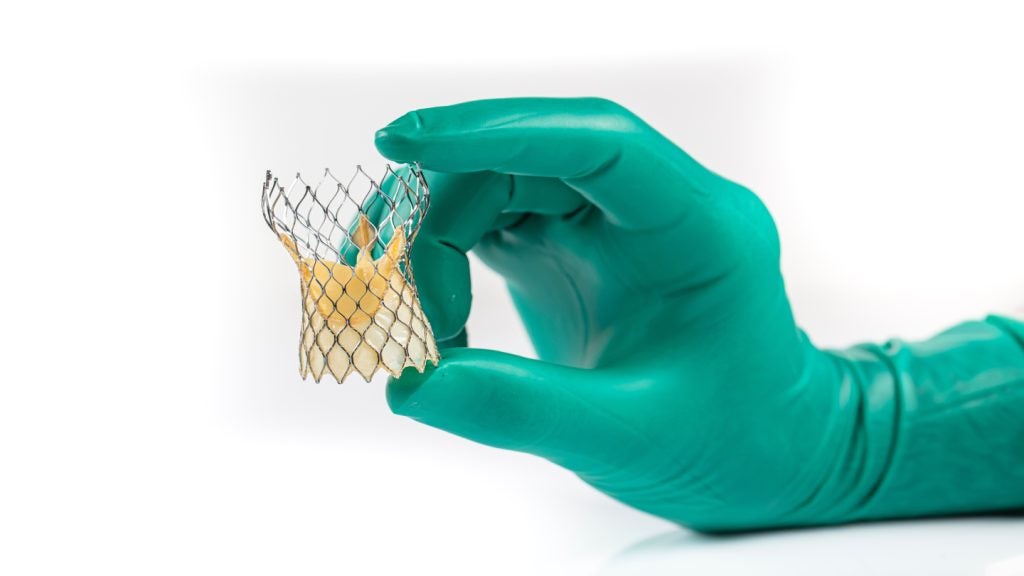

In cardiovascular medtech, we see a lot of activity around structural heart - families of devices that are intended to solve structural problems, or anomalies within the heart itself. In this area, there is a particular focus on valvular diseases. And while innovation in the last 20 years has mostly focused on the aortic valve, which is the most important and dominant valve of the human heart, in the last decade, we've seen a migration of innovation towards the mitral valve.

Within the last five years, a lot of innovation has also focused on the tricuspid valve. On the right side of the heart, it mediates the flow of blood from the right atrium to the right ventricle and has profound heart failure implications.

Interventional heart failure and mechanical circulatory support, where we at Magenta are operating, continue to be major sources of innovation. We also continue to see, although to a lesser extent, innovation related to coronary vasculature, the peripheral vasculature, and various aortic diseases such as abdominal aortic aneurysm (AAA).

RL: Why has structural heart innovation progressed in the way it has?

DI: The aortic valve has been the focus of innovation for the last 20 years, not only because it is one of the most important valves in the human heart, but because it has relatively simple anatomy. As a passive valve bypass valve, it opens and closes in response to the pressure gradient across the aortic valve. In contrast, the mitral and tricuspid valves are active. There are muscles called papillary muscles that are connected to these valves, so they respond to opening and closing, not just in response to pressure gradients, but also in response to contraction and relaxation of these papillary muscles. The mechanical machinery operating the mitral and the tricuspid valves is much more complex than the passive aortic and pulmonary valves of the heart. The major source of innovation has been in finding hardware that can fit into a variety of anatomies, to suit a variety of patient conditions and pathologies and still interact with the heart over many years.

RL: What form does innovation take in addressing these challenges?

DI: These need to be durable therapies, and they need to interact safely with the surrounding anatomy. Innovation is therefore not just about process; it's as much about engineering and considerations around iterative design, that allow us to come back with implants that are more complex in nature and expected to provide more complex solutions and interactions than what we've previously seen with other valves like the aortic valve.

RL: How do you characterise the competitive landscape of cardiovascular startups in Israel?

DI: There is intra-country competition and competition on a global scale. Most innovations nurtured and created in Israel have a global outlook. In terms of the course that innovation takes, there is a bit of a herd mentality, but this is not unique to the Israeli ecosystem. When there are clusters of talented people tackling similar problems, multiple companies tend to emerge in similar fields. I think this creates healthy competition in general, both for funding and for the quality of the innovation. And over the life of companies, only the best emerge as commercially viable.

However, the majority of competition needs to be viewed on a global scale. Israeli companies in this field are not just looking at their neighbours but at other medtech hubs around the world. While this is the US market first and foremost, there are other important markets with emerging medtech innovation, including Asian markets like China and Japan.

RL: How challenging is the process of bringing new innovations to market?

DI: Unsurprisingly, many therapies that deal with the heart, like the mechanical circulatory support device we have developed at Magenta, are on the higher end of the risk spectrum. Therefore, they require the most rigorous of development, validation, and testing methodologies to prove from a regulatory standpoint that they are safe, effective, and can be introduced into a commercial setting.

The devices featured in the Biomed session were mostly Class III devices, and it is not uncommon for these to take over ten years from concept to market approval. This path is fraught with myriad engineering and operational business funding challenges for a company to be able to withstand this period and finally introduce a valuable therapy to the market.

RL: How do you view the future course of innovation?

DI: Innovation is on an incredibly accelerated and optimistic pathway, in the sense that the work being done in cardiovascular medicine is becoming increasingly multidisciplinary.

If work in the cardiovascular space has traditionally maintained a separate focus on areas including mechanical engineering, stents, or implants related to valvular diseases, we now see companies integrating more elements of what technology has to offer because it provides a more well-rounded solution to many therapies.

For example, we see companies that are now incorporating software and mechanical and electronic hardware into their development. We also see a lot of medical devices create, supply, and send data to the outside world.

The ability to bring seemingly unrelated disciplines to the same R&D boardroom and come up with a solution that views the therapy more holistically highlights the advantages of the Israeli ecosystem. It is one adept at problem-solving and brings many different innovators to the same table to provide a more comprehensive solution.